Bitcoin has long been the first stop for new crypto investors. That pattern may be changing. A recent CoinGecko survey suggests fewer first-time buyers are starting with Bitcoin. Instead, they are trying other assets and products for their first purchase.

This does not mean Bitcoin is losing relevance. It still dominates market cap and headlines. The shift looks more like diversification at the entry point. As crypto matures, beginners have more options and more ways to get exposure.

What the CoinGecko Survey Says

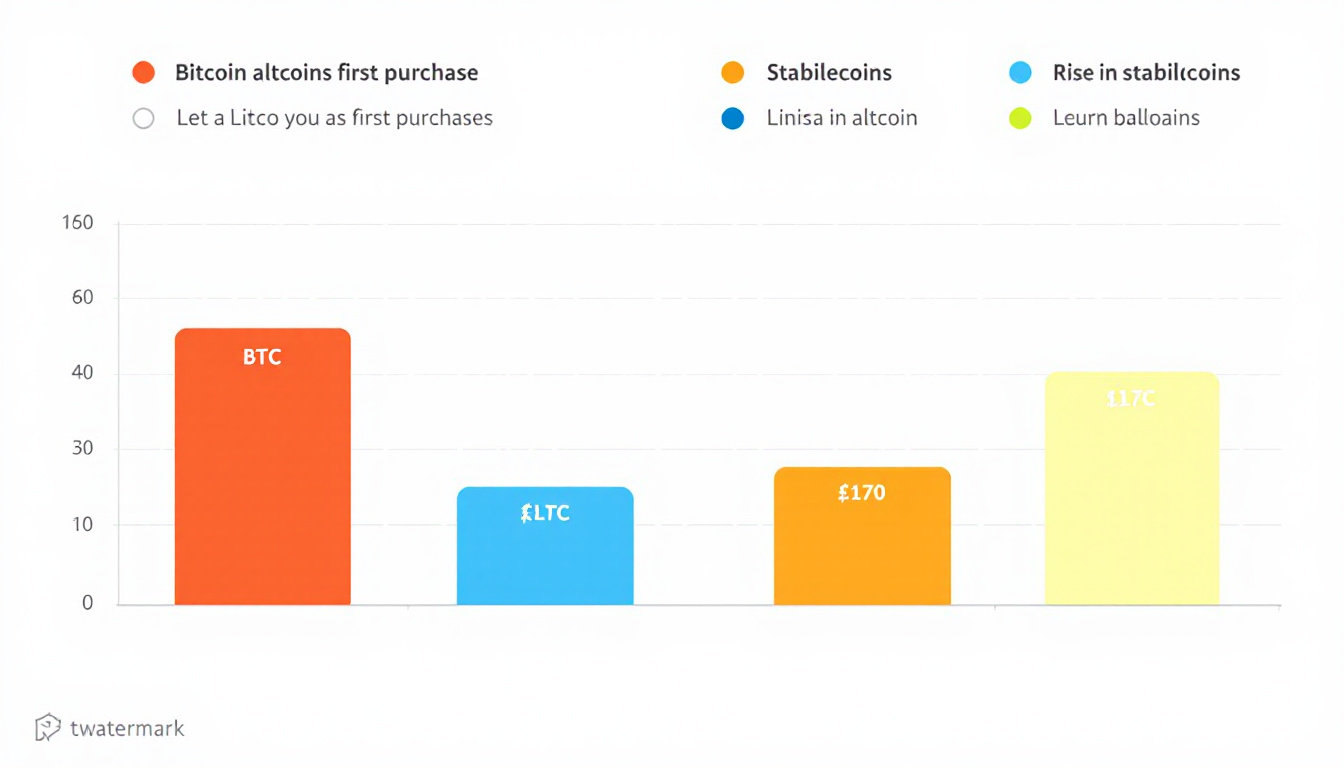

The survey looked at first-purchase behavior among new crypto investors. The key takeaway is simple: a smaller share of beginners pick Bitcoin as their first buy compared to prior years. Altcoins, stablecoins, and even non-spot products are gaining ground as first steps.

- More newcomers report buying a major altcoin first, such as Ethereum or a top L2 token.

- Stablecoins are popular for parking funds before moving into other assets.

- Some users begin with ETFs or earned-yield products offered by exchanges and apps.

Context matters. Access, on-ramps, and localized products vary by region. In some markets, Bitcoin still dominates first buys. In others, fees, local listings, and marketing push newcomers toward different starting points.

Why Fewer Beginners Start With Bitcoin

There are several reasons this shift makes sense in 2024 and 2025:

- More choice at the top: Years ago, Bitcoin and Ethereum were the only widely known names. Today, top exchanges feature many established projects on the front page, along with staking, points, and promotions.

- ETF and app UX: Spot Bitcoin ETFs helped mainstream adoption, but app interfaces now guide beginners into bundles, points programs, or diversified starter packs.

- Stablecoin habit: Many first-time buyers start with USDT or USDC to test deposits, avoid volatility, and then ladder into other coins later.

- Social discovery: Crypto education on YouTube, TikTok, and X often showcases narratives beyond Bitcoin, such as AI tokens, L2 ecosystems, or restaking. New users follow those stories into their first buys.

- Fees and speed: On some chains, new users prefer lower fees and faster transactions, which can nudge a first buy toward alternatives, especially during busy periods.

What This Means for Bitcoin

A smaller share of first buys does not equal a weaker Bitcoin. Many new users still buy Bitcoin later as they learn. Bitcoin remains the leading long-term store-of-value narrative. It is also the anchor asset for many portfolios.

However, early exposure matters. If the first experience is an altcoin or a stablecoin, that can shape behavior, risk tolerance, and holding patterns. It can also affect which communities and tools a user adopts long term.

Impacts on Exchanges and Builders

For on-ramps, wallets, and exchanges, onboarding flows matter more than ever. The first screens, default tiles, and fee schedules can determine the first buy. Clear education and transparent costs help guide better choices.

- Onboarding UX: Simplify KYC and deposits. Offer clear starter paths, whether that is Bitcoin, a diversified basket, or a stablecoin on-ramp.

- Education at the point of purchase: Provide plain-language risk notes, volatility examples, and tax tips before the first trade.

- Fee clarity: Show total costs by asset and network. Surprises push users away.

- Local relevance: Surface assets and payment methods that fit regional demand and rules.

Tips for New Crypto Investors

If you are just getting started, here are simple steps to reduce risk and learn faster:

- Start small: Use an amount you can afford to hold through volatility. Test deposits and withdrawals.

- Pick a secure on-ramp: Choose a reputable exchange or broker with clear fees and support.

- Understand the asset: Read a short primer on Bitcoin, Ethereum, or any coin you buy. Learn what it does and why it might hold value.

- Beware of hype: If your first buy is driven by social media, pause and double-check the basics.

- Plan custody: Decide if you will self-custody. Practice small transfers before moving larger amounts.

- Track taxes: Keep records from day one. It saves time later.

What It Means for Content Creators and Educators

The first-touch moment is shifting. That is a chance to help people build safer habits earlier. If your audience includes new investors, consider short guides that compare first-purchase options: Bitcoin, ETH, stablecoins, and beginner bundles. Explain how fees, networks, and custody differ. Use simple charts and checklists. Link to glossaries and wallet tutorials.

Also, meet users where they are. If many start with stablecoins, offer a step-by-step on moving from a stablecoin balance into a diversified portfolio. If your readers come in through L2 ecosystems, explain bridges, risks, and gas management in plain language.

Will Bitcoin Regain First-Buy Dominance?

It could. If fees fall and on-ramps push Bitcoin as the default, new users may shift back. A stronger price cycle can also renew attention. But the broader trend is variety. Crypto now includes many products that offer different trade-offs. That makes a one-size-fits-all starting point less likely.

In the meantime, Bitcoin’s role as a core holding remains intact for many. The first buy may not be Bitcoin, but the second or third often is.

CoinGecko’s survey points to a real change: fewer new investors start with Bitcoin. This reflects better access to altcoins and stablecoins, new product types, and changing onboarding flows. It is a sign of a maturing market with more choice, not a loss of relevance for Bitcoin.

To contact us click Here .