Taiwan Semiconductor Manufacturing Company, or TSMC, sits at the center of the global chip market. When a major research firm like Bernstein updates its view, investors listen. The key questions today are simple. Will demand for AI chips keep pushing TSMC higher? Can smartphone and PC cycles pick up enough to support the rest of the business? And how should investors think about risks like geopolitics and capacity plans?

This article breaks down the main drivers behind Bernstein’s outlook on TSMC, why it matters for the broader semiconductor sector, and what to watch if you are investing in chipmakers, fabless designers, or AI beneficiaries.

Why TSMC Matters

TSMC is the world’s leading pure-play foundry. It manufactures chips for many of the biggest names in tech, including Apple, Nvidia, AMD, and Qualcomm. Its leadership in advanced process nodes, like 5nm, 4nm, and 3nm, gives customers the performance and efficiency they need for AI data centers, premium smartphones, and high-performance computing.

Because of its scale and technology edge, TSMC’s guidance often acts like a pulse for the chip industry. When TSMC signals stronger orders, it implies better demand for the devices and data centers that use those chips. When it plans big capital spending, it suggests confidence in future demand and a pipeline of complex products that only a handful of foundries can build.

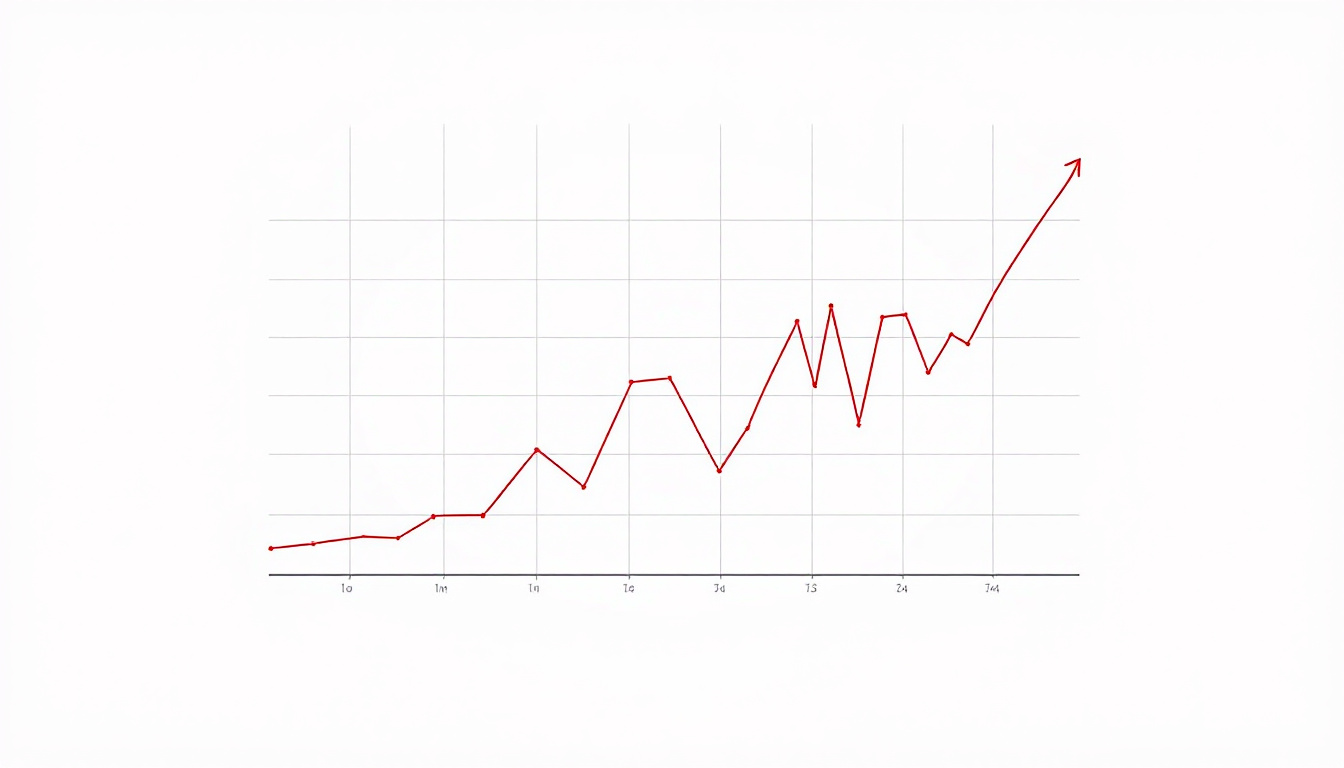

AI Is Still the Main Engine

The biggest tailwind remains AI infrastructure. Training large AI models and running inference needs advanced GPUs and custom accelerators. These chips are dense, power-hungry, and tricky to make. That favors TSMC. As long as hyperscalers keep building AI capacity, TSMC stands to benefit through steady high-value wafer shipments and strong pricing on leading-edge nodes.

Investors should watch three signals: first, order visibility from top AI chip customers; second, the pace of node migration to 3nm and below; third, any signs of supply tightness that could support margins. If AI spending stays resilient, it can offset softness in other end markets and keep utilization high.

Smartphone and PC Cycles: Gradual, Not Explosive

Outside AI, the consumer side is healing, but slowly. The smartphone market looks past the worst of the downcycle. Premium devices with advanced system-on-chips tend to lean on TSMC’s newest nodes. That helps mix and margins even if total unit growth is modest. PCs are similar. The upgrade cycle for AI-capable laptops is real, but it will likely stretch over several years, not quarters.

For TSMC, this means less of a volume surge and more of a mix story. Higher-value chips on newer nodes can lift average selling prices, even with flat units. That is helpful for gross margin stability, which investors closely track.

Capex and Capacity Planning

TSMC’s capital expenditure plans tell a story about demand confidence and technology roadmaps. Elevated capex typically points to advanced node ramping, substrate needs, packaging investments like CoWoS, and geographic diversification. For AI, advanced packaging is a bottleneck. Any expansion there can unlock additional GPU and accelerator shipments and support revenue growth.

Investors should pay attention to management commentary on lead times and packaging capacity. If constraints ease, it could pull forward revenue for AI-related products. If constraints persist, it may cap near-term upside but support pricing and margins.

Geopolitics and Supply Chain Risk

No TSMC discussion is complete without addressing risk. Geopolitical tension around Taiwan remains a headline risk for the entire semiconductor ecosystem. TSMC is diversifying production with facilities in places like the United States and Japan. This reduces concentration and helps customers with supply chain resilience, but it also raises costs and complexity during the ramp phase.

For investors, this is a long-term positive if it strengthens customer trust and unlocks government support, but near-term it can pressure returns on invested capital. The key is whether TSMC can maintain its process leadership while executing on global expansion.

Margins, Pricing, and Node Leadership

TSMC’s edge comes from its consistent node leadership. If it delivers strong yields at 3nm and advances toward 2nm on schedule, it can defend pricing power. Higher-performance chips with lower power draw justify premium pricing, especially for AI and flagship mobile. Watch for signals on yield improvements and customer adoption. Stable or rising utilization at advanced nodes often translates into healthy gross margins.

Currency swings can also affect reported results. Many chip companies manage this through hedging, but FX is still a swing factor to keep in mind when reading quarterly numbers.

What Bernstein’s Stance Signals for the Sector

If Bernstein is constructive on TSMC, it usually implies confidence in AI demand, improved visibility in advanced packaging, and a gradual recovery in consumer devices. That tends to be supportive for:

- Fabless leaders selling AI GPUs, accelerators, and premium mobile SoCs

- Equipment makers tied to advanced lithography, packaging, and substrate capacity

- Substrate, memory, and power component suppliers connected to AI servers

A cautious or neutral stance would likely reflect concerns about order digestion after a hot AI buildout, or slower consumer recovery. It could also flag risks around pricing, capex efficiency, or macro headwinds.

Key Metrics to Watch Next

- Advanced node mix: share of revenue from 5nm, 3nm, and below

- CoWoS and advanced packaging capacity and lead times

- Capex guidance and any changes tied to AI demand

- Utilization rates and gross margin trajectory

- Customer concentration and visibility on AI orders

- Geographic diversification progress and costs

Investor Takeaways

If you believe AI spending stays strong, TSMC is positioned to benefit. Its leadership at advanced nodes, packaging investments, and deep customer ties give it a durable moat. Consumer recovery should help on the margins, while node transitions support pricing. The main risks are geopolitical, capacity execution, and an AI digestion phase if hyperscalers pause spending.

For diversified semiconductor investors, TSMC’s guidance can serve as a barometer. Positive commentary often spills over to fabless chip designers, tool vendors, and AI data center suppliers. A cautious tone may hint at a reset period. Align your time horizon with the node and packaging ramps; these stories play out over years, not weeks.

TSMC remains the backbone of modern computing. Bernstein’s outlook, especially if it leans positive, underscores strong structural demand from AI and a steady return to health in premium consumer devices. Keep an eye on advanced packaging capacity, 3nm adoption, and capex signals. These will likely dictate revenue momentum and margin health into the next few quarters.

Disclaimer: This article is independent commentary and not investment advice. Always do your own research. Notes – The images are already hosted. You can use them as-is or upload to your WordPress Media Library and replace the URLs. – Want me to add SEO meta title, meta description, and a suggested permalink for this post, lad?