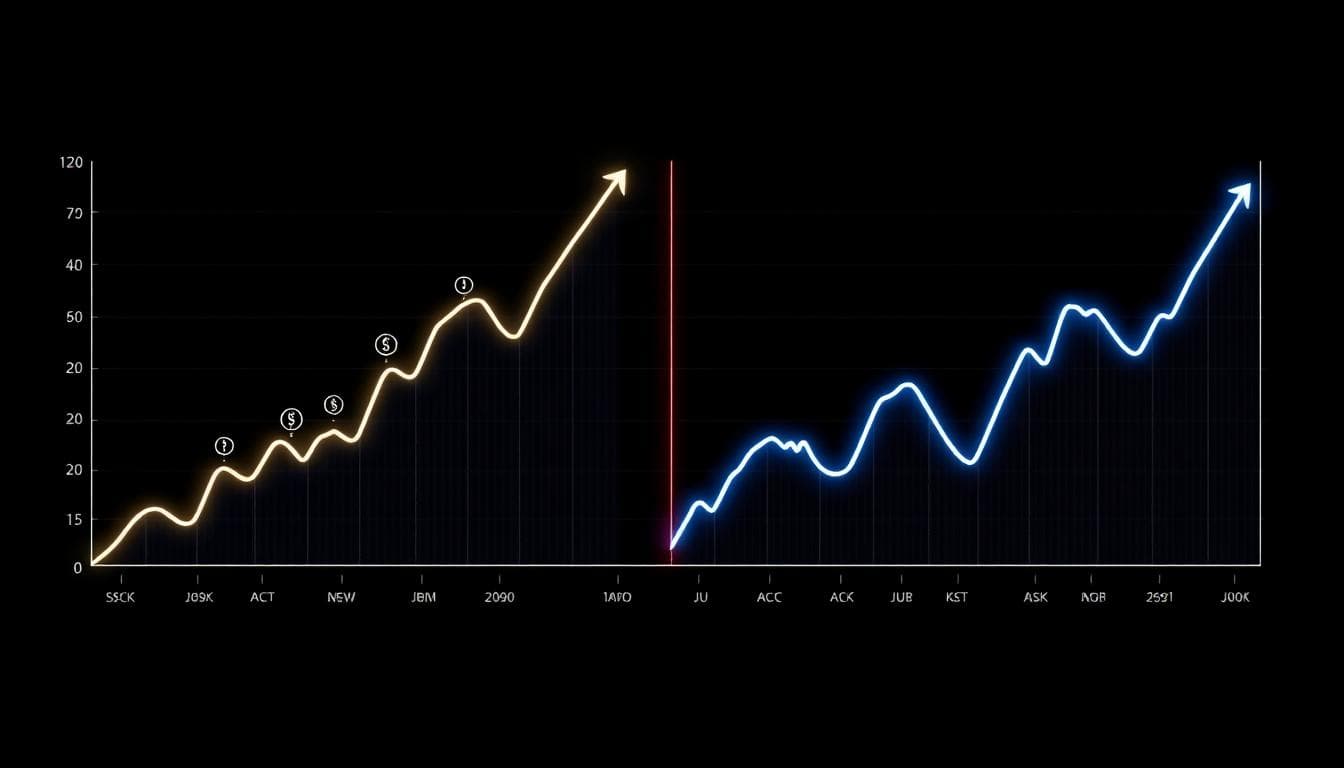

Choosing between stocks and crypto can feel confusing. Both can grow your money. Both carry risk. The best choice depends on your goals, your timeline, and your risk tolerance. In this guide, we break down the key differences, the pros and cons, and a simple way to decide how much to put into each.

Quick Take

- Stocks are tied to real companies, earnings, and cash flow.

- Crypto is driven by supply, demand, and network adoption.

- Stocks tend to be less volatile; crypto can swing fast.

- Diversification across both can smooth your ride.

How Stocks Create Value

Stocks represent ownership in a company. When a business earns money and grows, investors benefit. You can see value in revenue, profits, dividends, and buybacks. Over long periods, major stock indexes have trended upward as economies expand and companies innovate.

What helps stocks:

- Strong earnings and free cash flow

- Reasonable valuations

- Dividends that compound

- Stable regulations and transparency

Risks with stocks:

- Market downturns and recessions

- Company-specific issues

- Sector rotation and interest rates

How Crypto Creates Value

Crypto assets are digital, global, and tradable 24/7. Many aim to be money, platforms, or utilities. Value often comes from network effects, scarcity, and usage. For example, Bitcoin has a fixed supply schedule. Smart contract platforms host apps and transactions, which can drive demand for their tokens.

What helps crypto:

- Growing adoption and user activity

- Scarcity and predictable issuance

- New apps, payments, and use cases

Risks with crypto:

- High volatility and large drawdowns

- Regulatory changes by country

- Security risks, scams, and hacks

Risk and Volatility: What to Expect

Stocks usually move slower than crypto. You can see 1 to 3 percent daily swings in major stock indexes, sometimes more. Crypto can swing 5 to 20 percent in a day. Big upside comes with big drops. If you lose sleep watching price moves, keep your crypto slice small.

Time in the market matters more than timing the market for most investors. A simple, boring plan often wins over time.

Time Horizon and Goals

Your timeline should guide your mix:

- If you need the money within 1 to 3 years, you likely want less crypto and more stable assets.

- If you have a 5 to 10 year horizon, a blended approach can work well.

- If you can handle big swings and want growth, a small crypto allocation may boost returns.

Fees, Taxes, and Practical Stuff

Consider costs. Many stock index funds are very low fee. Crypto trading fees can be higher, and spreads can add up. On taxes, both can create taxable gains when you sell. Holding over a year can improve tax rates in many regions. Check rules in your country, and keep good records.

Also think about custody. Stocks sit in brokerage accounts. Crypto requires secure storage. If you self-custody, learn wallet security, use hardware wallets, and keep backups. If you use an exchange, pick a reputable one and enable all security settings.

How Much To Put in Stocks vs Crypto

There is no one-size-fits-all rule. Use your goals, risk tolerance, and timeline to pick a mix. Start simple. Here are example allocations to consider. Adjust to your needs:

- Conservative: 80 to 90 percent stocks, 0 to 5 percent crypto, 10 to 15 percent bonds or cash

- Balanced: 60 to 70 percent stocks, 5 to 10 percent crypto, 20 to 30 percent bonds or cash

- Aggressive: 70 to 85 percent stocks, 10 to 20 percent crypto, 0 to 10 percent bonds or cash

Start at the low end of crypto. Rebalance on a schedule, such as once or twice a year. This locks in gains and controls risk.

Simple Portfolio Setups

Here are two simple approaches you can implement in minutes:

Index Core + Crypto Tilt: Use a broad stock index fund as your core. Add a small crypto position. Rebalance yearly. Keep position sizes small enough that a drop does not derail your plan.

All-Weather Lite: Mix stocks, bonds, cash, and a small crypto slice. The goal is smoother returns across market cycles. Review your mix twice a year and adjust as your life changes.

When Stocks May Make More Sense

- You need lower volatility and steadier growth

- You prefer assets backed by earnings and cash flow

- You want dividends and a long track record

When Crypto May Make More Sense

- You accept large swings for potential upside

- You believe in long-term adoption of digital assets

- You can store and secure assets responsibly

Common Mistakes to Avoid

- Putting too much into one coin or one stock

- Chasing pumps and panic selling dips

- Skipping a plan and not rebalancing

- Ignoring fees, taxes, and security

You do not have to pick one. For many people, a stock-first portfolio with a small crypto slice offers growth and balance. Set clear goals, choose a mix you can stick with, and review it on a schedule. If you sleep well at night and stay consistent, you are likely on the right path.

To contact us click Here .